Trying to forecast your farm business cash flows can feel going to the dentist or paying school fees – painful. Yet cash flow budgeting is becoming an increasingly necessary skillset for farmers to access as they face mounting requests from banks as they demand insights into business operations and debt repayment strategies.

Clients often express frustration, believing banks should have all necessary information or citing unpredictable factors like weather. However, despite the grind, cash flow forecasts serve as invaluable tools for communicating business plans to stakeholders—banks, suppliers, and family members alike—guiding high-level decisions and indicating funding needs.

Understanding that cash flow budgeting is an ongoing process akin to painting Sydney’s Harbour Bridge is crucial. Budgets require regular updates, as circumstances change. Yes, your budgets have a shelf life.

A successful approach involves breaking down cash flow management into three main timeframes: strategic, tactical, and operational.

STRATEGIC CASH FLOWS

Strategic cash flows budgets aim to forecast cash inflows and outflows over multiple years, with less detail involved and more attention to capital investments, divestment or purchases to power your farm business forward.

TACTICAL CASH FLOWS

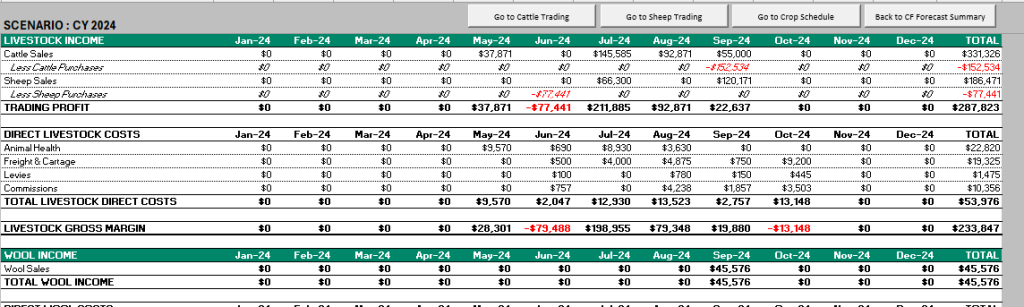

Tactical cash flow budgeting usually encompasses a full 12 month growing season or financial year. This type of cash flow helps map out a plan for your business that is loosely matched to growing rates, market cycles and availability of labour and machinery. This is the type of cash flow that stakeholders are most interested in.

Tactical budgets, however, should be used with caution. If you’re predicting a cash windfall in November while preparing budgets in January, also be prepared for disappointment – the variables could move in an instant. This is the evidence that these cash flows have a shelf life.

While tactical or yearly budgets may come with a ‘Caution’ sign, you can’t do without them. They are the compass for your more frequent operational decision making, but they don’t live in isolation.

OPERATIONAL CASH FLOWS

By breaking your tactical forecasts into operational budgets, you can development more timely information and business ‘waypoints’ as the season unfolds. Operational budgets may be weekly, monthly or quarterly. Either way, regularly preparing and reviewing short-term budgets provides an insight into income expenses that can help form important decisions as the year progresses

Cato Advisory builds bespoke financial models that we use to find you the best agri finance solutions for your business.

Click on the button below to contact us or book an appointment on our booking form. We’d love to hear how we can help you get the best out of your business planning.

This article also appeared in the Central West and Hilltops Farmer liftout on Friday, 7th June 2024