For agribusinesses and commercial enterprises, evaluating long-term investments like equipment, infrastructure, or vehicles is crucial to maintaining operational efficiency and profitability.

Equivalent Annual Cost (EAC) is a valuable tool that helps businesses make cost-effective decisions by comparing investment options with different lifespans.

EAC translates the total cost of owning, operating, and maintaining an asset into an annualised figure. This allows farmers and rural businesses to assess options fairly, ensuring they choose the one that provides the lowest cost per year over its useful life.

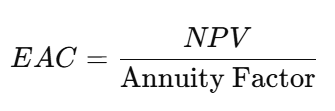

The calculation involves determining the Net Present Value (NPV) of all cash flows over an asset’s lifespan and converting it into equivalent annual payments using an annuity formula. This includes maintenance, loan payments, even tax impacts on disposal.

The formula is:

The annuity factor considers both the time value of money (accounting for interest rates) and the asset’s expected lifespan.

For instance, a livestock producer deciding between two tractors—one costing $120,000 with a 10-year life span and another costing $90,000 with a 7-year life span—can use EAC to determine which option minimises annual costs, factoring in maintenance, repairs, and fuel efficiency.

Cato Advisory specialises in helping commercial and agribusinesses make informed financial decisions. Whether you’re evaluating equipment purchases or restructuring your operations, our expertise ensures you maximize value and efficiency.

Click below to explore our services or make an appointment.

This is general advice only. Have a detailed discussion with us to ensure your personal circumstances are considered.