Australian banks are not expecting the RBA to lift rates yet, but that could change when the Reserve Bank of Australia meets on June 17-18 when its expected they will set the stage for rate rises should inflation be shown to be rising.

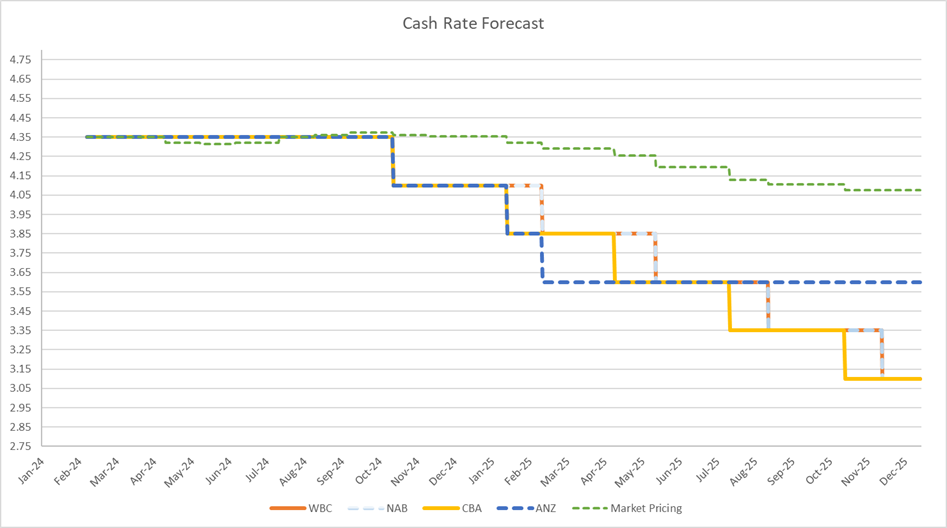

All four major banks are expecting a flat or falling official cash rate towards the end of 2024, with the prospect of further cuts in mid-2025. But the market isn’t as optimistic, with implied rates drifting slowly over the next 18 months – the ‘higher for longer’ scenario.

Inflation for the year ending March 2024 was stubbornly high at 3.6% while the April monthly indicator also held that rate. The next important inflation date is for the year to June 2024, which will be released in on July 31.

Australia’s GDP recorded its weakest growth since 1992 for the March quarter, notching up 0.1% growht for the quarter and only 1.1% for the year since March 2023. While this data – and evidence of a softening labour market – would support easing interest rates in Australia, persistent inflation – particularly in housing – continues to nag policymakers.

Central banks start to eases rates

The Bank of Canada dropped its official overnight rate by 0.25% on Wednesday to 4.75%, becoming the first G-7 nation to see its rates fall this monetary cycle, and the European Central Bank followed suit with an official cut from 4.00% to 3.75%.

Share markets responded in kind with investors fortelling the end of higher rates, however economic conditions remain uncertain across all major economies.