Hopes of a dramatic rate cutting to by Australia’s central bank in May have retreated following US president Donald Trump’s backflip on widespread punitive global trade tariffs.

Australian financial markets at one point were pricing in a 0.75% cut to official cash rates by the Reserve Bank of Australia at its next monetary policy meeting in May 2025.

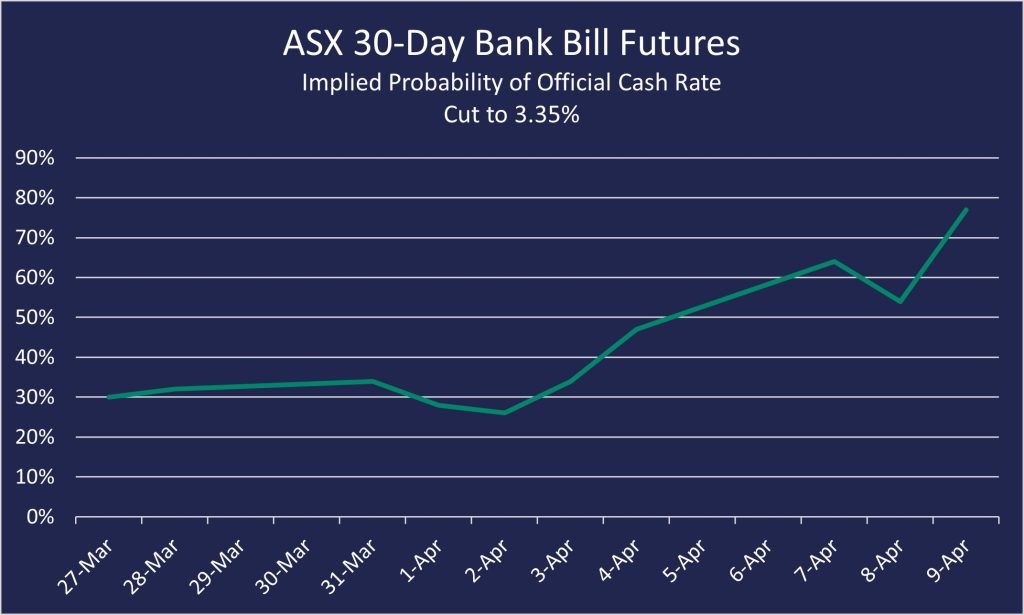

At the close of trade on April 9, the Australian Securities Exchange (ASX) RBA Rate Tracker, which tracks 30-Day Interbank Cash Rate Futures contract prices, indicated an implied 77% chance of a cut to 3.35% in May, from 4.10%.

But the move was shortlived – by lunctime on April 10, hopes of a cutting spree had unwound with only a 40% chance baked in for a May cut. Economists now expect four rate cuts by Christmas 2025.

The official cash rate is not a borrowing rate for Australian businesses, but is highly correlated to borrowing base rates like the Bank Bills Swap Rate, or BBSW. The 90-Day BBSW rate – the Australian commercial lending benchmark rate – is currently at its lowest level in more than 12 months, indicating more favourable conditions for borrowers.

The market’s sudden voltility around cuts are in response to US President Donald Trump’s broad-based trade tariffs – and then their eventual pause – that has ignited fresh concerns about predictability from the world’s largest economy.

The new trade position had triggered sell offs in major equities indices globally. By April 9, Australia’s S&P/ASX 200 index had fallen by 7.1% since April 2 while in the US the S&P 500 has dropped more 11% in the days following the announcement.

However, equities regained some of their confidence after Trump announced a “pause” to the tariff regime, putting all trading partners except China on the 10% tariff. The S&P/ASX200 4.75% by midday trading on April 10.